Cash Flow from Financing Activities CFF Financial Edge

Purchases or sales of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions (M&A) are included in this category. In short, changes in equipment, assets, or investments relate to cash from investing. A company will commit to using future cash flows as a means to pay back a loan. Lenders use the information on a company’s cash flow statement, along with information about a company’s accounts payable and accounts receivable, to project future cash flows.

Strong free cash flow is powering Fluence to further growth

- This issue has only worsened since mid-last year, particularly in storm-affected areas where claims stack up and insurance payments are backlogged.

- U.S.-based companies are required to report under generally accepted accounting principles (GAAP).

- Since 1988 it has more than doubled the S&P 500 with an average gain of +24.15% per year.

- Note that while the principal purpose of the cash flow statement is to understand the net change in cash for the given period (typically monthly), we also want to know where the cash came from, and where it went.

Russell Midcap® Growth Index measures the performance of US mid-cap companies with higher price/book ratios and forecasted growth values. S&P 500® Index measures the performance of 500 US companies focused on the large-cap sector of the market. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment. Two areas that are important in any cash flow projection are a company’s receivables and payables. Accounts receivables are payments owed from customers for goods and services sold.

How is cash flow from property, plant, and equipment different from the cash flow statement?

Large, mature companies with limited growth prospects often decide to maximize shareholder value by returning capital to investors in the form of dividends. Companies hoping to return value to investors can also choose a stock buyback program rather than paying dividends. A business can buy cash flow from financing activities its own shares, increasing future income and cash returns per share. If executive management feels shares are undervalued on the open market, repurchases are an attractive way to maximize shareholder value. Financing activities show investors exactly how a company is funding its business.

Cash Flow from Financing Activities (CFF)

- As their manager, would you treat the accountants’ error as a harmless misclassification, or as a major blunder on their part?

- Lastly, we get to cash flow from financing activities, which, as discussed, describes cash movements related to financial activities like debt issuances and equity rounds.

- At a 10X P/E, shares trade at a distinct discount to their historical 10-year average of 14X and are also cheaper relative to LKQ’s auto parts retailer peers, which arguably have similar long-term growth profiles.

- If the company defaults on the loan—which means they don’t pay back the principal and interest payments—the lien allows the bank to legally seize the assets.

- Last year, it sold its BioPharma Solutions business at a significant premium, and this year it is exiting the kidney business.

- Missed payments may also prevent you from paying off your plan within the period you chose when you set up the plan.

As noted above, the CFS can be derived from the income statement and the balance sheet. Net earnings from the income statement are the figure from which the information on the CFS is deduced. But they only factor into determining the operating activities section of the CFS. As such, net earnings have nothing to do with the investing or financial activities sections of the CFS. To summarize other linkages between a firm’s balance sheet and cash flow from financing activities, changes in long-term debt can be found on the balance sheet, as well as notes to the financial statements. Dividends paid can be calculated by taking the beginning balance of retained earnings from the balance sheet, adding net income, and subtracting out the ending value of retained earnings on the balance sheet.

- Since this is the section of the statement of cash flows that indicates how a company funds its operations, it generally includes changes in all accounts related to debt and equity.

- Negative cash flow should not automatically raise a red flag without further analysis.

- For investors, the CFS reflects a company’s financial health, since typically the more cash that’s available for business operations, the better.

- To do this, make sure you locate the total cash inflow and the total cash outflow.

- Accumulated depreciation at the start of the year was $300,000 but depreciation expense of $230,000 was then reported as shown above.

- Add the change in cash to the beginning cash balance to arrive at the ending cash balance, ensuring it matches the cash balance reported on the balance sheet.

What are the benefits of financial activities?

Financial activities can also help you manage your finances more effectively and make wise decisions about your money. To wrap up, the cash flow from financing is the third and final section of the cash flow statement. By contrast, debt and equity issuances are shown as positive inflows of cash, since the company is raising capital (i.e. cash proceeds). Negative Cash Flow from investing activities means that a company is investing in capital assets.

Compound Interest: A Guide to Long-Term Financial Growth

Conversely, many circumstances may cause a large negative cash flow from financing activities. Struggling businesses forced to repay loans due to covenants, partnerships executing a planned wind-up, and maturing companies able to repay debt may all have similar cash flow from financing activities. A positive cash flow from financing activities shows that a business raised more cash than it returned to lenders and owners.

When Were Credit Scores Invented? A Journey Through Financial History

We are ultimately stock pickers, but when we look at the valuation gaps that exist between mid caps and large caps and value versus growth, these relative spreads have reextended to highly attractive levels. Compared to P/Es of 22.4X and 27.8X (FY1 earnings) for the S&P 500® and Russell Midcap® Growth Indices, the Russell Midcap® Value Index sells for just 16.1X. Not since the dot-com bubble have these valuations spreads been this attractive.

Capital Funding: Debt vs. Equity

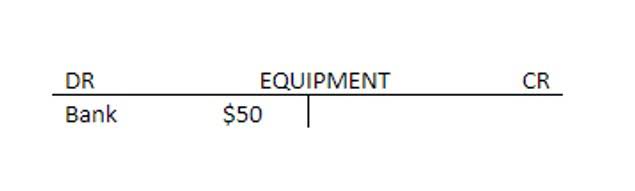

In addition, the general ledger reports a $25,000 loss on the early extinguishment of a debt. Once again, the journal entry for this transaction can be recreated by logical reasoning. https://www.bookstime.com/articles/accounting-errors This transaction is analyzed first because the cost of the equipment is already provided. However, the accumulated depreciation relating to the disposed asset is not known.

If there is an amount that is still owed, then any differences will have to be added to net earnings. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Hopefully, this has been a helpful guide to understanding how to account for a company’s funding activities. CFI is the official provider of the Financial Modeling & Valuation Analyst (FMVA)® designation, which can transform anyone into a world-class financial analyst.

How to Calculate Retained Earnings: Formula and Example

Either way, the net income and therefore the retained earnings, belongs to the owners and forms part of the owners equity. The retained earnings for each year accumulate on the Retained Earnings account which forms part of the owners equity in the balance sheet. The statement uses information from the beginning balance what is the normal balance for retained earnings sheet and the income statement for the year, and provides information to the ending balance sheet. The other is an action on the part of the board of directors to increase paid-in capital by reducing RE. The act of appropriation does not increase the cash available for the acquisition and is, therefore, unnecessary.

Shareholder Equity Impact

As mentioned earlier, retained earnings appear under the shareholder’s equity section on the liability side of the balance sheet. Likewise, the traders also are keen on receiving dividend payments as they look for short-term gains. In addition to this, many administering authorities treat dividend income as tax-free, hence many investors prefer dividends over capital/stock gains as such gains are taxable. At the end of the period, you can calculate your final Retained Earnings balance for the balance sheet by taking the beginning period, adding any net income or net loss, and subtracting any dividends.

Do you already work with a financial advisor?

- Accountants use the formula to create financial statements, and each transaction must keep the formula in balance.

- Therefore, the calculation may fail to deliver a complete picture of your finances.The other key disadvantage occurs when your retained earnings are too high.

- In other words, a company that aims to grow must be able to put its money to work, just like any investor.

- This, of course, depends on whether the company has been pursuing profitable growth opportunities.

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. There are numerous factors to consider to accurately interpret a company’s historical retained earnings. All of the other options retain the earnings for use within the business, and such investments and funding activities constitute retained earnings. If the company is experiencing a net loss on its Income Statement, then the net loss is subtracted from the existing retained earnings. Finally, provide the year for which such a statement is being prepared in the third line (For the Year Ended 2019 in this case).

What factors impact your retained earnings balance?

- Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

- When a company pays dividends to its shareholders, it reduces its retained earnings by the amount of dividends paid.

- To better explain the retained earnings calculation, we’ll use a realistic retained earnings example.

- Positive retained earnings are a good sign, while long-term negative figures indicate financial trouble.

On the other hand, investors prefer securities that pay a constant rate of dividend periodically, which reduces the risk of investing in the shares. A maturing company may not have many options or high-return projects for which to use the surplus cash, and it may prefer handing out dividends. The decision to retain earnings or to distribute them among shareholders is usually left to the company management. However, it can be challenged by the shareholders through a majority vote because they are the real owners of the company. Profits generally refer to the money a company earns after subtracting all costs and expenses from its total revenues.

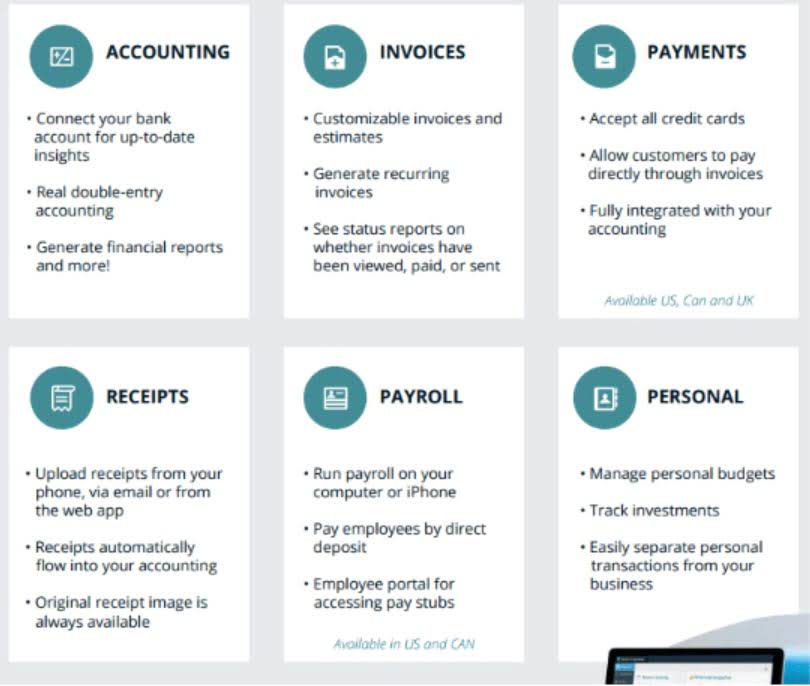

Create and send branded invoices, add fast payments, nudge late payers and track job expenses. This account forms part of the equity of the business, as it is retained in the business but belongs to the equity holders. A financial professional will offer https://www.bookstime.com/ guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- Savvy investors should look closely at how a company puts retained capital to use and generates a return on it.

- This is the new balance in the retained earnings account and it will be displayed on the balance sheet as of the last day of the current accounting period.

- The decision to retain earnings or to distribute them among shareholders is usually left to the company management.

- The trouble is that most companies use their retained earnings to maintain the status quo.

Use an income statement to figure out your profit

For example, financial institutions are often subject to strict regulatory capital requirements that affect the use of these earnings. Companies should adhere to these regulations to maintain their financial stability and legal compliance. When a prior period adjustment is used, it appears as a correction of the beginning balance of RE and is fully described. With the relative infrequency of material errors, the use of this type of adjustment has been virtually eliminated. To naïve investors who think the appropriation established a fund of cash, this second entry will produce an apparent increase in RE and an apparent improved ability to pay a dividend. As such, some firms debited contingency losses to the appropriation and did not report them on the income statement.

- This line item reports the net value of the company—how much your company is worth if you decide to liquidate all your assets.

- Further, figuring your retained earnings helps your company work out cash projections and draw up a budget for the year ahead, which will also be necessary to shareholders.

- Retained earnings are the portion of income that a business keeps for internal operations rather than paying out to shareholders as dividends.

- This result is your net income, showing what the company earns after covering all its costs.

Calculate and Subtract Dividends Paid to Shareholders in Current Period

Overtime Calculator For Overtime Pay

Overtime is over and above the standard 40-hour workweek. The rate is one and a half times the normal pay rate the employee earns. Learn more about how to do payroll from start to finish.

Field Technician – Menasha, WI

- This is your gross overtime wages for the number of hours entered above, multiplied by the number of payroll periods in the year.

- With that said, it’s commonpractice among most employers to provide additional pay on these occasions as a way to motivate and maintain the satisfaction of their workers.

- Whatever the limit is (some laws contain other thresholds), the employer should compensate for each hour exceeding the normal threshold.

- You can also try to get to know your colleagues better.

- The Trump administration’s 2019 rule updated the salary piece of the “white collar” exemption so that workers earning less than roughly $36,000 a year would be automatically eligible for time-and-a-half pay.

- This would instantly calculate the total time worked in Excel for each employee.

- Double overtime pay is like an extra reward for employees who put in additional hours or work on holidays (personal holidays or public holidays).

Employees on an hourly salary will usually get time and a half if they work more than 40 hours a week; in some states, they’ll also get it when they work morethan 8 hours in one day. Some companies also offer what is overtime for $23 an hour time and a half to an employee that works on holidays. However, all these rules can vary between statesand between companies. You’ll use simple multiplication to figure out the overtime pay for an employee.

Overtime Pay Eligibility – Can Salary Employees Get Overtime?

Enter a rate of return in the following form and click the „Calculate Time to Double“ button to see how long it will take to double your overtime wages if you invest them instead of spending them. The following overtime chart answers the question, „What is time and a half for $X.XX an hour?“ and contains the most common searched-for hourly wages, but you can update the chart to suit your preferences. If your multiplier is not in the list, selecting the „Other“ option will reveal a field wherein you can enter your custom multiplier.

How do I calculate hours worked in Excel?

The agency uses the Fair Labor Standards Act as the basis for the regulations. Employers need to heed overtime rules or face stiff penalties. The standard overtime rate is one and a half times the hourly rate for each hour over 40 hours worked. By using these Excel formulas to calculate time worked, you can streamline your employee time tracking and ensure accurate payroll. Whether you need to track regular hours, overtime, or breaks, Excel provides the tools you need to get the job done efficiently. If you make $23 an hour, your yearly salary would be $47,840.

- Currently, these include Alaska, Nevada, Puerto Rico, and the Virgin Islands.

- To calculate overtime hours in Excel, you’ll need to first calculate the total regular hours worked, and then use an IF statement to check if the employee exceeded the overtime threshold.

- Chances are, if the calculator is not working at all, you may be missing out on other content on the web due to an outdated or non-conforming web browser.

- If you would like the calculator to calculate how much you would earn annually in overtime wages if you worked a given number of overtime hours each pay period, select your pay period.

- Let’s take a look at what the overtime entitlements are in the U.S. and how they can vary by state…

- Named ranges make formulas easier to understand by replacing cell references with meaningful names.

The number of normal working hours for a particular job position is established to balance the employee’s health, productivity over the workday/shift, and general economic factors. It’s known that the human organism is naturally limited and cannot sustain the same level of productivity in the 8th or 10th hour of work as at the beginning of the shift. For more additional assistance, check out our free overtime calculator.

- The list of exemptions is detailed in the next section.

- For the sake of argument, let’s say you worked 48 hours this week.

- California requires that employees get paid overtime regardless of whether the overtime was approved or not.

- According to federal law, the vast majority of workers in America are entitled to overtime.

- For example, let’s say that a worker normally works 40 hours per week.

- Time and a half refers to a 50% increase in an employee’s regular hourly pay rate received from an employer for overtime hours worked.

- Switching time units assumes you work 5 days a week and there are approximately 4.3 weeks in the average month.

- Some of the other provisions of the act protect child workers under the age of 16 from hazardous occupations.

- Many exempt jobs fall in the first category only, with managerial and executive positions often exempt from overtime.

- Our compassionate legal team helps you stand up for your rights with confidence.

- She has an MBA in Finance and a Bachelor’s in Economics.

- Employees on an hourly salary will usually get time and a half if they work more than 40 hours a week; in some states, they’ll also get it when they work morethan 8 hours in one day.

- If your multiplier is not in the list, selecting the „Other“ option will reveal a field wherein you can enter your custom multiplier.

Knowing how to calculate your correct overtime wages is crucial. Every day, millions of employees lose out on their earned overtime due to overtime violations. The lesson is clear – your employer may be taking advantage of you, but without following your own hours, you would never know. Some salaried employees are eligible for overtime pay. Overtime is a great way for salaried employees to increase their annual income.

Jobs paying $23 an hour by Job Title

Time and a Half Calculator

Five Steps to Optimize Net Working Capital Bain & Company

Since the growth in operating liabilities is outpacing the growth in operating assets, we’d reasonably expect the change in NWC to be positive. Still, it’s important to look at the types of assets and liabilities and the company’s industry and business stage to get a more complete picture of its finances. Most major new projects, like expanding production or entering into new markets, often require an upfront investment, reducing immediate cash flow. Therefore, companies needing extra capital or using working capital inefficiently can boost cash flow by negotiating better terms with suppliers and customers. Get instant access to video lessons taught by experienced investment bankers.

Boost sales revenue

- Positive working capital generally means a company has enough resources to pay its short-term debts and invest in growth and expansion.

- But if current assets don’t exceed current liabilities, the company has negative working capital, and may face difficulties in growth, paying back creditors, or even avoiding bankruptcy.

- Use the historical data to calculate drivers and assumptions for future periods.

- This, in turn, can lead to major changes in working capital from one month to the next.

- This means your business would have to search for additional sources of finance to fund the increased current assets.

If a balance sheet has been prepared with future forecasted periods already available, populate the schedule with forecast data as well by referencing the balance sheet. At the very top of the working capital schedule, reference sales and cost of goods sold from the income statement for all relevant periods. These will be used later to calculate drivers to forecast the working capital accounts. It might indicate that the business has too much inventory or isn’t investing excess cash. Alternatively, it could mean a company fails to leverage the benefits of low-interest or no-interest loans.

Add Up Current Liabilities

A company’s collection policy is a written document that includes the protocol for tackling owed debts. If you’re seeking to increase liquidity, a stricter collection policy could help. Cash comes in sooner (and total accounts receivable shrinks) when there is a short window within which customers can hold off on paying. The net working capital (NWC) metric is different from the traditional working capital metric because non-operating current assets and current liabilities are excluded from the calculation. In financial accounting, working capital is a specific subset of balance sheet items and is calculated by subtracting current liabilities from current assets.

- A business has positive working capital when it currently has more current assets than current liabilities.

- Therefore, the impact on the company’s free cash flow (FCF) is +$2 million across both periods.

- Therefore, a risk-return tradeoff is involved in managing the current assets of your business.

- In financial accounting, working capital is a specific subset of balance sheet items and is calculated by subtracting current liabilities from current assets.

- But it is important to note that those unmet payment obligations must eventually be settled, or else issues could soon emerge.

- Further, excessive investment in your current assets may diminish your business profitability.

How to Calculate Working Capital Cycle

Using hedging strategies to offset swings in cash flow can mitigate unexpected changes in working capital. However, there are some costs involved in these hedging transactions, which could affect cash flow. Changes in net working capital refers to how a company’s net working capital fluctuates year-over- year.

Any change in working capital can affect cash flow, which is the net amount of cash and cash-equivalents being transferred in and out of a company. If the change in working capital is negative, it reduces cash flow. If the change in working capital is positive, it increases cash flow.

Fixed Charge Coverage Ratio: What It Is & How to Calculate

Subtract the latter from the former to create a final total for net working capital. If the following will be valuable, create another line to calculate the increase or decrease of net working capital in the current period from the previous period. A company can improve its working capital by increasing current assets and reducing short-term debts. To boost current assets, it can save cash, build inventory reserves, prepay expenses for discounts, and carefully extend credit to minimize bad debts.

These companies can easily meet short-term expenses even if their assets are tied up in long-term investments, properties, or equipment rentals. As it so happens, most current assets and liabilities are related to operating activities (inventory, accounts receivable, accounts payable, accrued expenses, etc.). Positive NWC shows that a company has the increase in net working capital financial resources to pay its current obligations with its short-term liquidity. In doing so, it can promote future growth and allow for borrowing power should you apply for financing. That being said, while a business should have a positive NWC, an NWC that’s too high signifies a business that may not be investing its short-term assets efficiently.

Negative Impacts

Generally, the larger your net working capital balance is, the more likely it is that your company can cover its current obligations. In fact, some large corporations have negative working capital, where their short-term debts outweigh their liquid assets. Typically, the only entities capable of remaining solvent amid these circumstances are behemoth corporations with significant brand recognition and robust selling power. Such companies are able to quickly generate additional funds, either by shuffling money from other operational silos, or by acquiring long-term debt.

What Is the Formula for Cash Flow?

Because working capital figures can vary widely over time, and because they may differ from business to business, it’s important to analyze this metric within a broader, more holistic context. The industry, company size, developmental stage, and operational model of the given business must all be considered when assessing financial stability based on levels of net working capital. How do we record working capital in the financial statementse.g I borrowed 200,000.00 Short term long to pay salaries and other expenses. On average, Noodles needs approximately 30 days to convert inventory to cash, and Noodles buys inventory on credit and has about 30 days to pay. Generally speaking, the working capital metric is a form of comparative analysis where a company’s resources with positive economic value are compared to its short-term obligations.

Positive Working Capital

On the other hand, a negative NWC means that a company will typically need to borrow or raise money to remain solvent. Net Working Capital Ratio refers to a ratio that includes all the components of your Net Working Capital. It is calculated by dividing the current assets of your business with its current liabilities.

What are indirect manufacturing costs?

Accordingly, the unit cost of production would be measured using the newest or oldest inventory items. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. The same cost can be labeled as indirect in one industry and direct in another.

Top 7 Differences Between Direct and Indirect Costs

Direct costs are almost always variable because they are going to increase when more goods are produced. Employee wages may be fixed and unlikely to change over the course of a year. However, if the employees are hourly and not on a fixed salary then the direct labor costs can increase if more products are manufactured.

Examples of indirect costs

Indirect costs are infeasible to allocate to each unit of product or service since these costs are used in multiple manufacturing activities and can’t be assigned to a single unit. Once NEH issues an award, it is not obligated to make adjustments due to increases in your organization’s indirect cost rate agreement. We encourage companies to review both their direct and indirect costs on a monthly basis. You need to keep track of your indirect costs because if they are increasing, you may need to price your goods differently—or quickly improve your efficiency in order to achieve a higher gross margin.

- For example, if an employee is hired to work on a project, either exclusively or for an assigned number of hours, their labor on that project is a direct cost.

- Profit margins serve as a good measure of how efficient and profitable a company is at providing its products and services.

- The tools used in construction projects — especially those that are reusable across different projects —are considered indirect costs.

- Indirect costs are costs that are not directly accountable to a cost object (such as a particular project, facility, function or product).

- By harnessing digital tools, construction firms can assist in bringing accuracy, foresight, and agility to their financial management.

Formula: How to Calculate Direct and Indirect Costs?

Indirect manufacturing costs are a manufacturer’s production costs other than direct materials and direct labor. Indirect manufacturing costs are also referred to as manufacturing overhead, factory overhead, factory burden, or burden. Continuous monitoring of direct and indirect expenses provides valuable insights into the efficiency of business operations to identify areas for improvement and cost optimization. For example, if an employee is hired to work on a project, either exclusively or for an assigned number of hours, their labor on that project is a direct cost.

What are Indirect Costs of a Cost Object?

At sustainable bedding retailer Ethical Bedding, founder and CEO James Higgins admits he monitors business costs more or less ‘constantly’. “It’s absolutely imperative to know your product costs and running costs because that’s how you know which levers to pull from a cost perspective, and how those costs are linked to revenue and ultimately profit,” he says. Modified Total Direct Costs, excludes equipment, capital expenditures, rental costs, tuition remission, scholarships and fellowships, participant support costs and the portion of each subaward in excess of $25,000. It is used mainly by manufacturing companies that produce several product lines or work with a number of businesses. The selling, general and administrative expenses to go to market are $10,000, $10,000 and $5,000, respectively.

Indirect costs include expenses such as the salaries of the project manager and administrative staff, renting office space to manage the project, and insurance and legal fees. Companies should review their indirect costs regularly and draw comparisons with prior periods. For example, they can compare their costs in January 2023 with those of January https://www.bookstime.com/ 2022. They can also compare the current year with the last fiscal year, as well as the actual numbers with those in the budget. This would allow business owners to spot trends and address cost issues as they arise. Just like direct costs, indirect costs can be numerous, and will typically differ considerably from one industry to another.

Data Analytics and Predictive Tools

- Certain government agencies might allow you to explain why indirect costs should be funded, too, but the decision to grant funding is at their discretion.

- Hence, mastering cost management is an important part of running and growing a business.

- They can integrate various aspects of construction project management, including budgeting and financial oversight.

- The financial analyst should also keep a close eye on the cost trend to ensure stable cash flows and no sudden cost spikes occurring.

Also referred to as manufacturing overhead, factory burden, factory overhead, and manufacturing support costs. Identifies any limitations on the use of the rates, the basis of accounting, rate specific information (such as indirect costs are also referred to as costs. fixed or provisional rates), the use of the NICRA by other federal agencies, and other information. Allocating costs is important and useful because it helps you understand whether you are pricing your goods competitively.

Correct allocation of direct and indirect costs leads to more accurate and transparent budgeting, forecasting and cash flow planning, as well as reporting for management and financial purposes. For example, factory overhead costs can be apportioned to each unit produced by the total number of products manufactured, or based on the number of hours it took to manufacture each product. This helps a company to calculate the overhead cost per unit so that prices can be set accordingly to ensure a profit is made on each product even after incorporating all indirect expenses.

Overhead Costs

Understanding direct costs and indirect costs is important for properly tracking your business expenses. Ultimately, determining a reasonable indirect cost rate requires careful analysis of the specific circumstances of a project and the construction company involved. Generally, a reasonable indirect cost rate falls within the range of 10% to 20% of the total direct costs of a project. A reasonable indirect cost rate can vary depending on a variety of factors, such as the type of construction project, the location, and the size of the construction company.

In an example of a car manufacturer, the materials like steel, plastic or glass used in the car production line are classified as direct costs. Indirect costs, although often overshadowed by their direct counterparts, hold significant sway over a project’s bottom line. Ensuring their meticulous assessment and proactive oversight not only safeguards profitability but also establishes the foundation for successful project execution. In construction, both indirect and soft costs denote expenses that aren’t directly tied to the physical construction activities. When an entity accepts a grant, such as government funding, the funding guidelines typically stipulate what qualifies as a direct versus indirect cost, along with any threshold amounts for each cost type. Understanding the true total cost of producing goods and services enables a business to make sound decisions, particularly in the areas of pricing, budgeting, operational efficiency, and taxation.